Military Romance Scams: Protecting Your Heart and Your Wallet

Romance scams have become one of the most devastating forms of fraud, with losses reaching $1.3 billion in 2022 according to the FTC. Among these heartbreaking schemes, military romance scams hold a particularly painful place, exploiting both our respect for service members and our desire for meaningful connections. If you’re wondering whether that charming soldier […]

Rent My Car On Turo? Weighing the Risks and Rewards

As the side hustle economy continues to grow, many vehicle owners are exploring car-sharing platforms like Turo as a potential source of income. The concept is appealing—turn your parked car into a revenue-generating asset. However, like any financial decision, it’s crucial to carefully evaluate both opportunities and risks before diving in. At Community Point Bank, […]

Vacation Budgeting Tips: Make Your Money Go Further

Planning a vacation is exciting, but the financial reality can sometimes dampen that enthusiasm. As your community financial partner, Community Point Bank understands that you work hard for your money and deserve a relaxing getaway without financial strain. Here are practical tips to help you budget effectively for your spring and summer adventures while maximizing […]

How to Adjust Your Budget for Inflation

Budgeting in an environment where inflation constantly creeps up on you can be frustrating. However, it doesn’t have to throw off your financial goals. Being proactive and taking control of your money can help you stay ahead of the line. Keep reading to learn how to account for inflation, adjust your budget and avoid lifestyle […]

What Does Member FDIC Mean for Banks?

Jump to: When you deposit your funds into a bank, you trust your money will be safe and available when you need it. The cash you need to pay your bills today and the funds you save for tomorrow are the result of your hard work and necessary for survival. Your relationship with your bank […]

Banking 101: What Does a Bank Loan Officer Do?

When taking your first step toward anything in life, it’s nice to have some guidance. A few significant steps include purchasing a home or car or starting a business. You may need to secure a loan to start, but the process can be overwhelming. However, with the right help, you can move forward with confidence. […]

7 Frustrating Holiday Shopping Scams to Avoid

The last thing you want to get wrapped up in this holiday season is a financial scam. Unfortunately, fraudulent activity tends to ramp up during the end of the year as scammers prey on those looking to score discounts on gifts and travel accommodations, make charitable contributions or seek companionship. According to a recent AARP […]

What Is an Interest-bearing Checking Account?

We’re all looking for ways to stretch our dollars. It feels good to have some breathing room in the budget to push for our financial goals. While you can start a side hustle or second job to make extra cash, you may be looking for a more passive way to earn money from your current […]

Pig Butchering Scam: What It Means & How to Protect Yourself

Jump to: It’s the investment scam with the unusual name – and it has nothing to do with barbecue. Pig butchering scams are based on the practice of fattening a hog before slaughtering the animal for its meat. In the first stage – known as “fattening the pig” – the scammer cultivates a relationship to […]

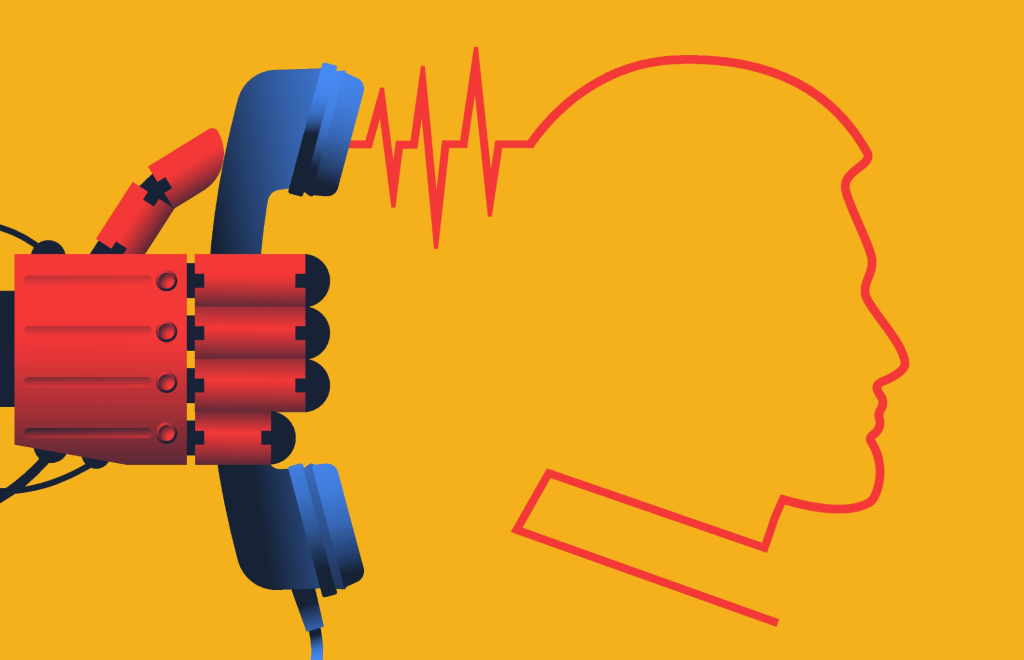

AI Financial Scams: How They Work and How to Avoid Them

Jump to: Financial scams are an unfortunate reality in today’s world. Fraudsters are constantly looking for ways to get you to part with your hard-earned cash. The sudden boom of communications technology and widespread Internet adoption in the 1990s and 2000s created avenues for scams that we deal with today. Phishing and its various forms, […]